Start-up broker-dealer “Aspiration” aspires to succeed via “pay us what you think we deserve” model; Palo Alto’s “Robinhood” offers “commission-free trading” and wants to make money the old-fashioned way: interest on deposits and margin loans (in a near-zero interest rate environment). For those inspired by this new trend, BrokerDealer.com provides a forum by which start-ups in the finance industry can network with prospective investors.

BrokerDealer.com blog update is courtesy of below extracts from 23 Dec NYT DealBook story by William Alden.

Editors note: For those not aware, the notion of “commission-free trading” is often a fallacy and a term that financial industry regulators somehow allow service providers to use, despite Finra’s self-acclaiming focus for cracking down on deceptive advertising. Few brokerdealers offer anything for ‘free’. Those who offer ‘commission-free’ trading for customers typically receive rebate payments aka payment for order flow checks in consideration for routing customer orders to the various electronic exchanges who dangle kickbacks in consideration for brokers delivering orders to their venue.

Andrei Cherny, Aspiration CEO

From Dealbook: “..A number of new financial start-ups are trying to reach younger and middle-class Americans by upending the customary fee structure of traditional brokerage firms and money managers. They are backed by deep-pocketed venture capital investors — and even celebrities like the rapper Snoop Dogg — who are wagering that these upstarts can challenge the Wall Street establishment…

Aspiration, a start-up wealth manager on Sunset Boulevard here, which had its official debut last month, is asking customers to pay whatever they think is “fair.” That can be as much as 2 percent of their assets, or as low as zero. Reflecting its high-minded goals, the company has also pledged to donate 10 percent of its revenue to charity.

Robinhood, a new brokerage firm based in Palo Alto, Calif., whose founders were inspired by the Occupy Wall Street movement, introduced an app this month that lets customers trade stocks without paying commissions. (The firm plans to make money by offering margin loans and by collecting a portion of the interest earned on customer money invested in money market funds.)

Big banks and brokerage firms haven’t been sitting still. Charles Schwab, for example, recently said it would introduce an automated investment service that doesn’t charge advisory fees. But many are constrained by new regulations or their own inertia. The public’s persistent skepticism of these institutions in the wake of the financial crisis hasn’t helped, either.

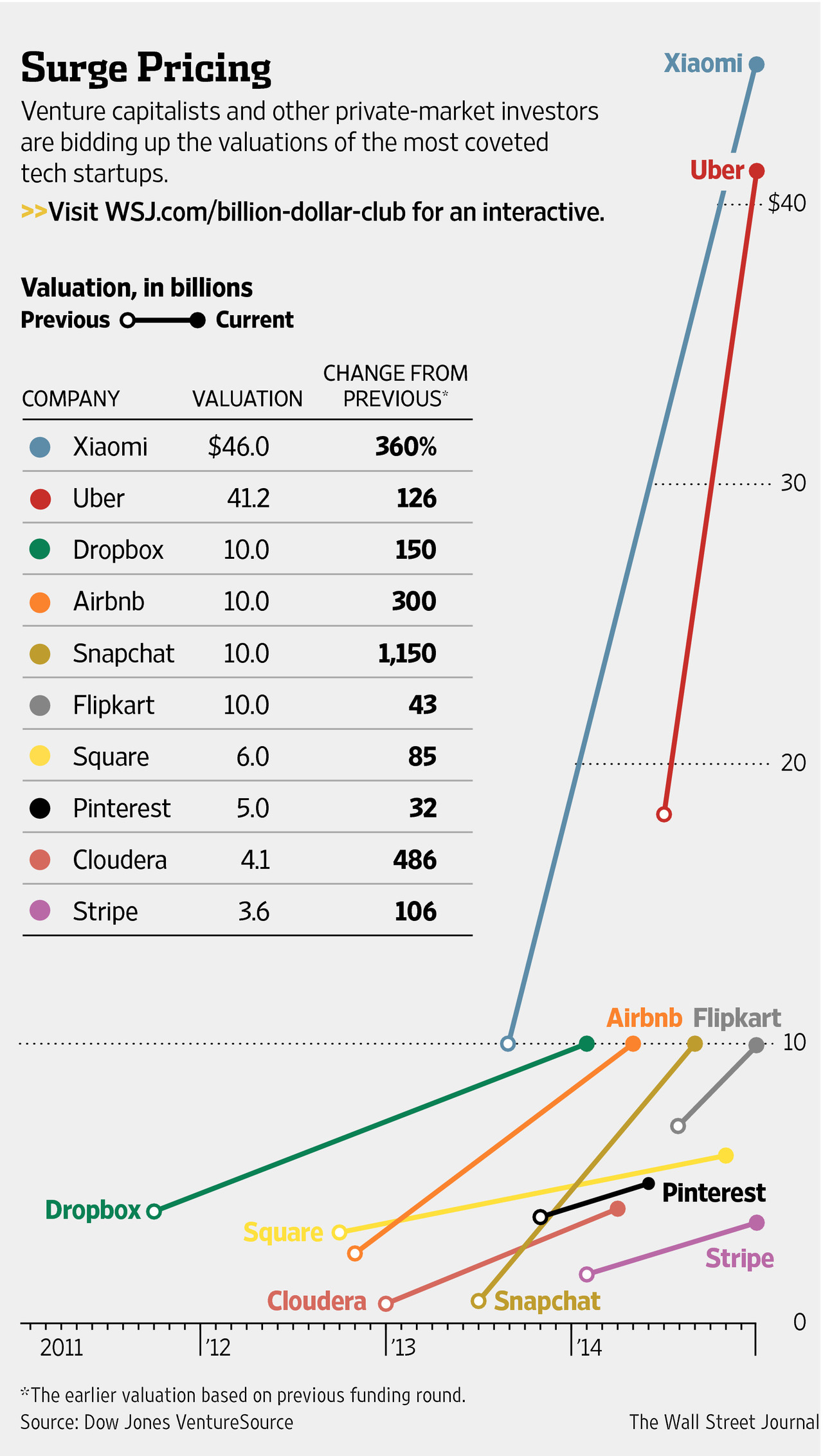

Some industry experts have voiced skepticism about the viability of the new business models, including those of Aspiration and Robinhood. But venture capitalists have been happy to bet that technology-focused start-ups can offer more appealing products for buying stocks or managing savings. Continue reading →

Brokerdealer.com blog update courtesy of extracts from 29 Dec edition of the Wall Street Journal, with reporting by Evelyn M. Rusli

Brokerdealer.com blog update courtesy of extracts from 29 Dec edition of the Wall Street Journal, with reporting by Evelyn M. Rusli