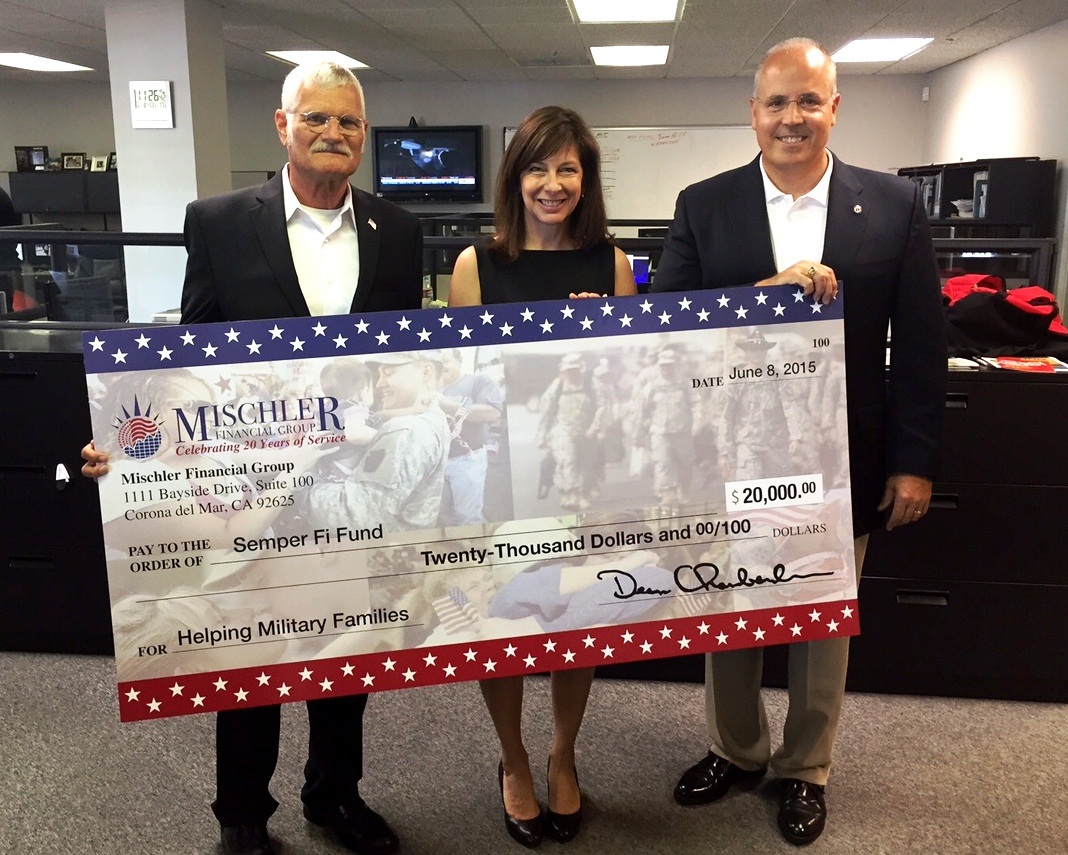

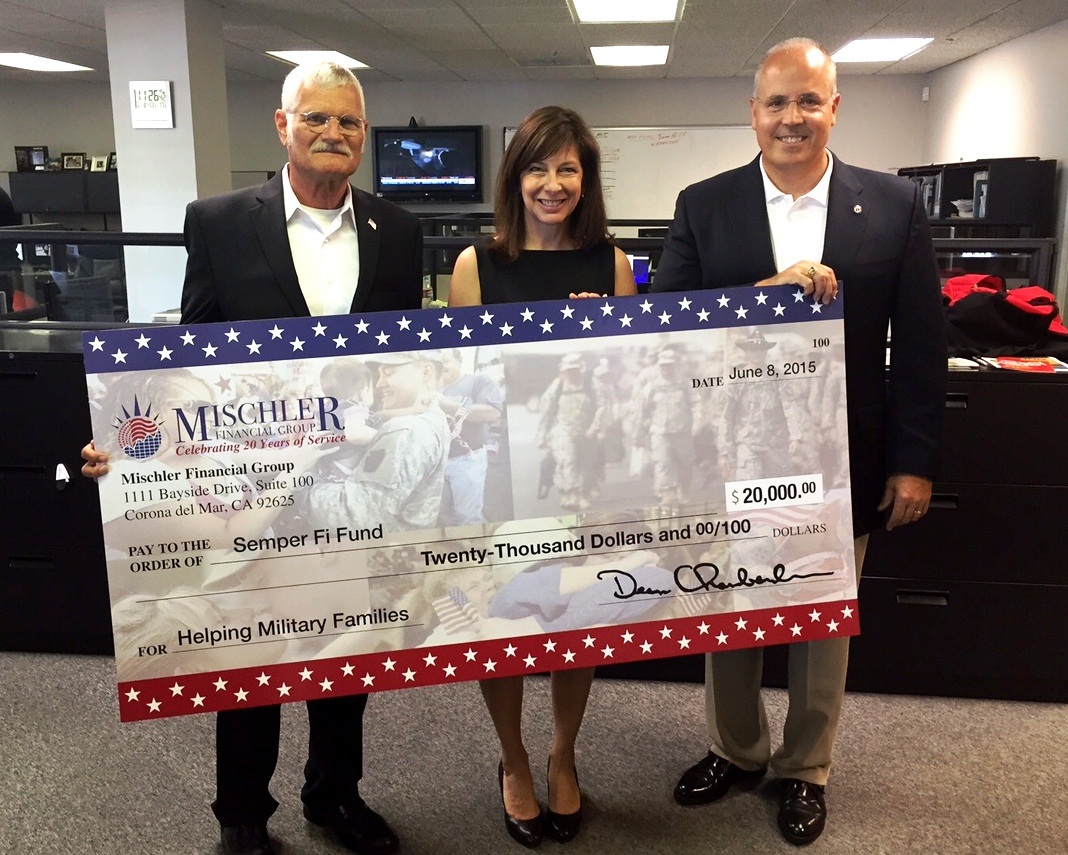

BrokerDealer Gives Back and Pays It Forward; Mischler Financial’s Memorial Day Pledge Yields $20k for Semper Fi Fund

Mischler Financial Group, Inc., the institutional brokerage and investment banking boutique, and the securities industry’s oldest firm owned and operated by Service-Disabled Veterans presented a check this week to Semper Fi Fund in the amount of $20,000 as a follow-on to the firm’s previously announced “Memorial Day Month” pledge.

Mischler Prez Doyle Holmes (l), Semper Fi Fund VP Wendy Lehtin (c), Mischler CEO Dean Chamberlain (r)

According to Mischler CEO Dean Chamberlain, a U.S. Military Academy alumni and a certified Service-Disabled Vet (SDV), “Our ongoing mission throughout our now, twenty-year history has always been to provide Fortune Treasury and investment management clients with stand-apart capital markets services and by extension, to pay back and pay it forward by sharing the benefits of our success with organizations that are dedicated to supporting service-disabled military veterans and their families in the most productive ways.”

Added Chamberlain, “Semper Fi Fund is exactly the type of organization that we are honored to align with and we’re thrilled that so many of our clients rallied behind our trading desks to express their support of this month-long fund raising initiative.”

The Semper Fi Fund, and its program America’s Fund, provide immediate financial assistance and lifetime support to post 9/11 wounded, critically ill and injured members of all branches of the U.S. Armed Forces, and their families, ensuring that they have the resources they need during their recovery and transition back to their communities.

Since its 2004 formation led by a group of Marine Corps spouses, Semper Fi Fund has provided more than 93,500 grants, totaling more than $109 million in assistance to over 14,000 of our heroes and their families. Recipients include qualifying post 9/11 Marines, Sailors, Soldiers, Airmen, Coast Guardsmen, and reservists with amputations, spinal cord injuries, Traumatic Brain Injury (TBI), severe Post Traumatic Stress Disorder (PTSD), burns, blindness, other physical injuries, or those suffering from life-threatening illnesses. Semper Fi Fund also help spouses and children of active duty service members who face a life threatening illness or injury.

About Mischler Financial Group, Inc.

Mischler Financial Group is headquartered in Newport Beach, California with regional offices in Stamford, CT, Boston, MA and Chicago, IL. MFG is a federally-certified minority broker-dealer and a Service-Disabled Veterans Business Enterprise (SDVBE) that provides capital markets services, agency-only execution within the global equities and fixed income markets and asset management for liquid and alternative investment strategies. Clients of the firm include leading institutional investment managers, Fortune corporate and municipal treasurers, public plan sponsors, endowments, and foundations. The firm’s website is located at http://www.mischlerfinancial.com