BrokerDealer and dark pool operator ITG and its affiliate AlterNet Securities will pay $20.3 million to settle charges that they operated a secret trading desk, the U.S. Securities and Exchange commission announced this week.

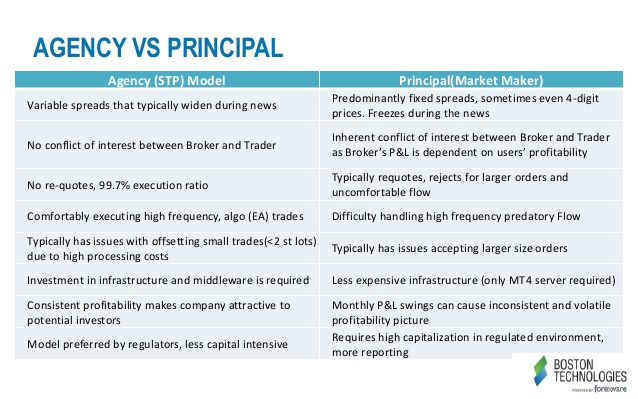

As described the SEC — and, unusually, admitted to by ITG ITG, -4.29% — there were two main charges — that the company operated a proprietary trading desk when it claimed to be “agency only,” and that it then used the confidential trading information of its dark-pool subscribers without disclosing that.

The regulator “found that despite telling the public that it was an “agency-only” broker whose interests don’t conflict with its customers, ITG operated an undisclosed proprietary trading desk known as “Project Omega” for more than a year.”

On Monday, ITG CEO Bob Grasser stepped down to be replaced by E*trade veteran Jarrett Lilien in the wake of the scandal and news of the SEC’s proposed fine. ITG General Counsel Mats Goebels also resigned, according to news reports.

An SEC press statement added, “[while] ITG claimed to protect the confidentiality of its dark pool subscribers’ trading information, during an eight-month period Project Omega accessed live feeds of order and execution information of its subscribers and used it to implement high-frequency algorithmic trading strategies, including one in which it traded against subscribers in ITG’s dark pool called POSIT.”

Unlike previous SEC settlements where the accused pays a fine and does not admit any guilt, ITG admitted wrongdoing. Further, it will “pay disgorgement of $2,081,034 (the total proprietary revenues generated by Project Omega) plus prejudgment interest of $256,532 and a penalty of $18 million that is the SEC’s largest to date against an alternative trading system,” according to the SEC.

“ITG created a secret trading desk and misused highly confidential customer order and trading information for its own benefit,” said Andrew J. Ceresney, director of the SEC’s Division of Enforcement. “In doing so, ITG abused the trust of its customers and engaged in conduct justifying the significant sanctions imposed in this case.”