Brokerdealer.com blog update inspired by 2 Jan WSJ column by business news journalist Liam Denning

Brokerdealer.com blog update inspired by 2 Jan WSJ column by business news journalist Liam Denning

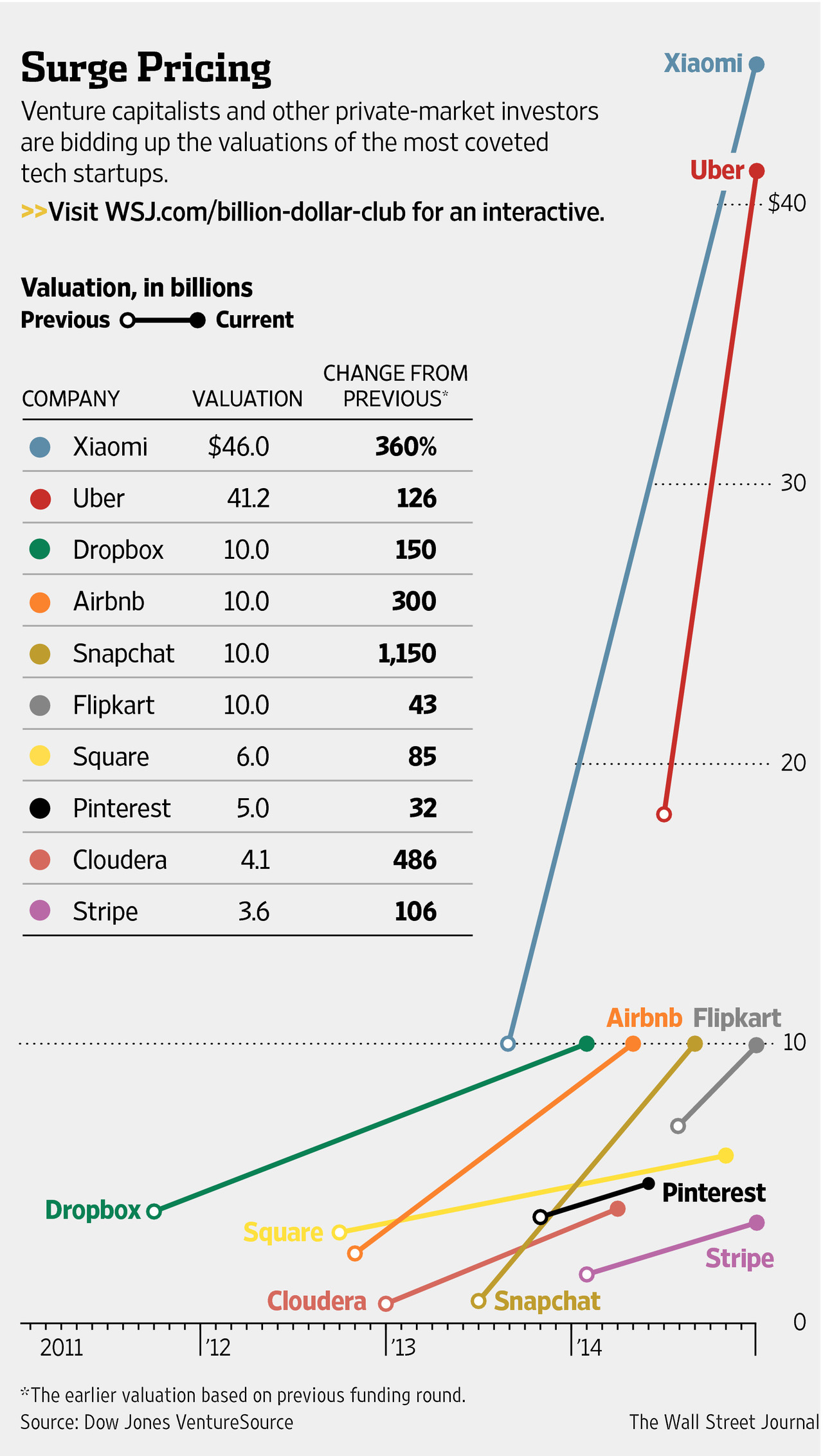

For broker-dealers, investment bankers, and those following the investment strategies of private equity and venture capital firms, this is one of the better plain-speak summaries profiling the current climate of investing in private companies. The recent outsized valuations during 2014 have caused greybeard investors to scratch their heads…as the outsized pre-IPO valuations are counter-intuitive to traditional investment analysis of private companies, particularly given the assortment of “lower-than-last-private round” post IPO valuations that these same companies are being given in the public marketplace.

For private companies that wish to network with deep-pocketed angel and/or institutional investors, Brokerdealer.com provides an investor forum that connects start-up entrepreneurs with those who can see the forest through the trees.

Below please find excerpts of Liam Denning’s reporting..

Buying a stock, with all its attendant filings, analyst coverage and forecasts, still can be a gamble. So imagine getting excited about one isolated price signal on a private company with all the disclosure of the Air Force’s Area 51.

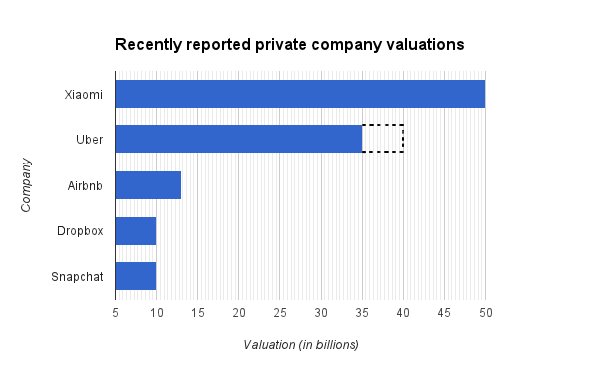

Yet that is what is setting pulses racing as 2015 dawns. Xiaomi, a closely held Chinese smartphone maker, recently raised $1.1 billion at an implied valuation of more than $46 billion. That puts it ahead of Uber Technologies, the unlisted ride-booking application developer that got new funding in December valuing it at $41 billion. Both numbers also are higher than the market capitalizations of roughly three-quarters of the S&P 500’s members.

In theory, such startup valuations matter little to anyone but a relative handful of founders, employees and venture capitalists. The average investor doesn’t get a seat at the table or more than an occasional glimpse of what even is on the table.

In practice, news of such amazing, and seemingly unobtainable, investments stoke bullish sentiment, leaving individual investors potentially vulnerable.

Venture capitalists and other insiders usually do extensive due diligence before committing to the likes of Uber. But their basis for valuation differs from the approach of mainstream investors buying stocks, with venture funds also considering exit timelines, the cash needs of a startup to keep expanding and maintaining incentives for management and owners as equity stakes get parceled out. They also can, of course, just get things wrong.

Ordinary investors also must consider the wider context. In a world thirsting for yield amid ultralow interest rates, money has sought riskier corners of the market. Almost $24 billion of new commitments flowed to U.S. venture funds in the first nine months of 2014, according to the latest data from Thomson Reuters and the National Venture Capital Association. That is more than in each of the preceding five years in their entirety and sets up 2014 to have been the biggest year for new venture money since before the financial crisis.

This raises the risk of dollars being deployed into questionable businesses, which then eventually find their way into the wider market via initial public offerings, which are priced off the back of those high startup valuations.

For the entire WSJ story, please click here.