Brokerdealer.com blog update courtesy of 18 January New York Times article.

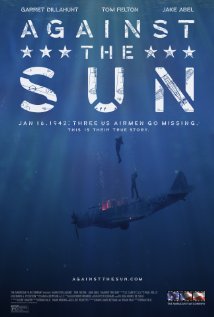

The former founder and Chairman of online brokerdealer Ameritrade Securities, Joe Ricketts, which since morphed through acquisition and is now known as TD Ameritrade, has a plan that only a creative finance industry czar could put together…and when it comes to creative financing, he’s found his calling in the film finance space. As part of the marketing strategy, Joe Ricketts’ film, “Against the Sun”, a movie about World War II, will donate a matching amount from sales to veterans’ organizations.

Take a quiz about your open-sea survival skills on Buzzfeed. Score maybe 7 of 10, marking you as the type who might make it through a midocean disaster. And up pops an offer of, say, 30 percent off the standard $15 price to buy “Against the Sun,” a new feature film about real Navy fliers who spent 34 days adrift on the Pacific duringWorld War II.

Brutally direct digital sales techniques are standard stuff for e-commerce marketers offering credit cards, resort vacations, shoes or even books that match your presumed tastes or mood of the moment. But movie marketers have been slower to adopt contemporary online equivalents to the classic foot-in-the-door hard sell. Too slow, by the thinking of Joe Ricketts and his colleagues at his American Film Company.

Mr. Ricketts is an entrepreneur who learned a few things about salesmanship while building the TD Ameritrade online discount brokerage firm, of which he was chief executive. Now he has pointed the indie movie studio he founded toward an experiment in the use of low-cost digital marketing techniques to sell “Against the Sun.” The film is directed by Brian Falk, and it includes Tom Felton — Draco Malfoy in the “Harry Potter” series — among its stars.

Made for a little less than $5 million, “Against the Sun” will be shown in a small number of theaters and on a wide range of cable, satellite and digital on-demand services like iTunes, starting Jan. 23. And its relatively modest marketing budget, set initially at $2 million, will be overseen by DigitasLBi, a company that has run digital campaigns for companies like American Express but has virtually no film experience.

Mr. Ricketts wanted “a digital firm, ideally one that had never marketed a movie before,” said Alfred Levitt, chief operating officer of American Film.

Speaking jointly with George Hammer, a Digitas senior vice president who is coordinating the marketing effort for “Against the Sun,” Mr. Levitt described the sales campaign. It is intended to enhance the impact of dollars spent by focusing on transaction-ready buyers with an appetite for World War II dramas like “Unbroken,” “Fury” and “The Imitation Game.” Conventional studios recently spent tens of millions of marketing dollars on those films.

American Film struck a deal with Participant Media. Its Takepart.com website, which prods film viewers to social action, will offer “Against the Sun” with both a discount and a matching donation to a veterans’ organization, hoping to turn the socially committed into immediate buyers.

Advised of the donation plan, Lou Baczewski glanced at the online trailer and said he was ready to sign on.

A tightly networked history buff, Mr. Baczewski has written a book — “Louch: A Simple Man’s True Story of War, Survival, Life and Legacy” — about his grandfather’s experiences as a World War II tank driver, and he says he is planning to retrace a European invasion route by bike, to raise money for the Honor Flight Network and others.

Mr. Baczewski said he would happily spend money on the film if part of the profits were donated to veterans. “What better way to depict the struggles and battles of human endurance than by telling a true story?” he said.

For the entire article, click here.

Brokerdealer.com blog update courtesy of The New York Times’ Susan Antilla.

Brokerdealer.com blog update courtesy of The New York Times’ Susan Antilla.