BrokerDealer.com provides news extract below courtesy of the Wall St. Journal

BrokerDealer.com provides news extract below courtesy of the Wall St. Journal

Banks are checking back into the hotel business.

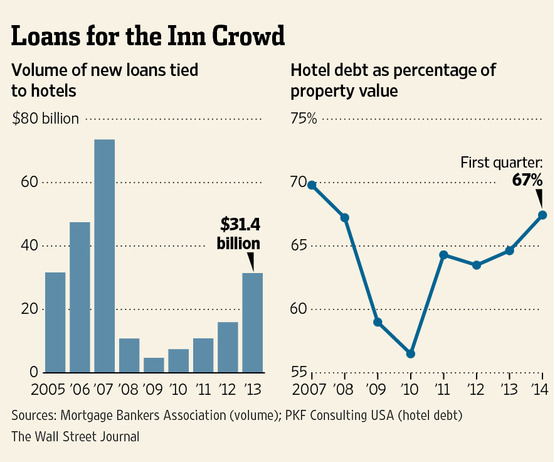

J.P. Morgan Chase JPM +0.63% & Co., Deutsche Bank AG and other firms are ramping up lending for lodging acquisitions and debt refinancing to levels not seen since before the financial crisis. Lenders made $31 billion in hotel loans last year, nearly double the 2012 level, according to the Mortgage Bankers Association, while all commercial-property lending rose 47%.

Credit is flowing against a backdrop of rising room rates, limited new construction and a spike in leisure and business travel in big cities such as New York and Los Angeles. Net operating income increased by 10% for the average U.S. hotel in 2013, according to PKF Consulting USA, which predicts “double digit annual gains” through 2015.

Credit is flowing against a backdrop of rising room rates, limited new construction and a spike in leisure and business travel in big cities such as New York and Los Angeles. Net operating income increased by 10% for the average U.S. hotel in 2013, according to PKF Consulting USA, which predicts “double digit annual gains” through 2015.

The easy money means hotel companies and investors can use less of their own cash to make deals, potentially amplifying returns. Debt now accounts for more than 67% of a hotel purchase price, up from about 56% in 2010, says PKF. That level is just below the high of around 70% in 2005.

Some of the largest hotel transactions have relied even more heavily on debt. NorthStar Realty Finance and a partner this month borrowed about $840 million from J.P. Morgan to acquire a 47-hotel portfolio for about $1 billion.

“There’s been a sea-change during the past two months,” says Monty Bennett, chief executive officer of Ashford Hospitality Trust, AHT +0.47% a Dallas-based hotel investor. “It’s pretty close to the 2007 lending environment again.”

The full WSJ article can be accessed by clicking here.