Brokerdealer.com update courtesy of the New York Post.

For many young people, internships are a gateway to a career in the industry they intern in. For one intern, the doors opened for opportunities outside of Wall Street with help from social media.

A female intern at a blue-chip financial firm won’t be pumping stocks any more after reportedly quitting her stuffy Wall Street gig to become a porn star.

Paige A. Jennings, who moonlights under the stage name Veronica Vain, dropped her internship at Lazard Asset Management last week after her nude selfies taken in the bathroom of the firm’s Manhattan offices were discovered online, according to Business Insider.

“I just left a job on Wall Street for a porn career because I can’t stop masturbating at work,” Jennings, 23, wrote on Twitter Wednesday.

Jennings had been a part-time intern in the company’s alternative-investments marketing group since last June, Business Insider said.

But after her co-workers discovered the nude bathroom photos posted on her Veronica Vain Twitter account, she soon decided to seek other employment.

“It was a little awkward,” Jennings told the website BroBible.com about meeting with her boss after the pics went public. “However, he obviously couldn’t have me coming back to the office when likely just about everyone had seen me half-naked

online.”

Jennings, a recent college grad, previously worked as a stripper but didn’t see it as “a viable career path.”

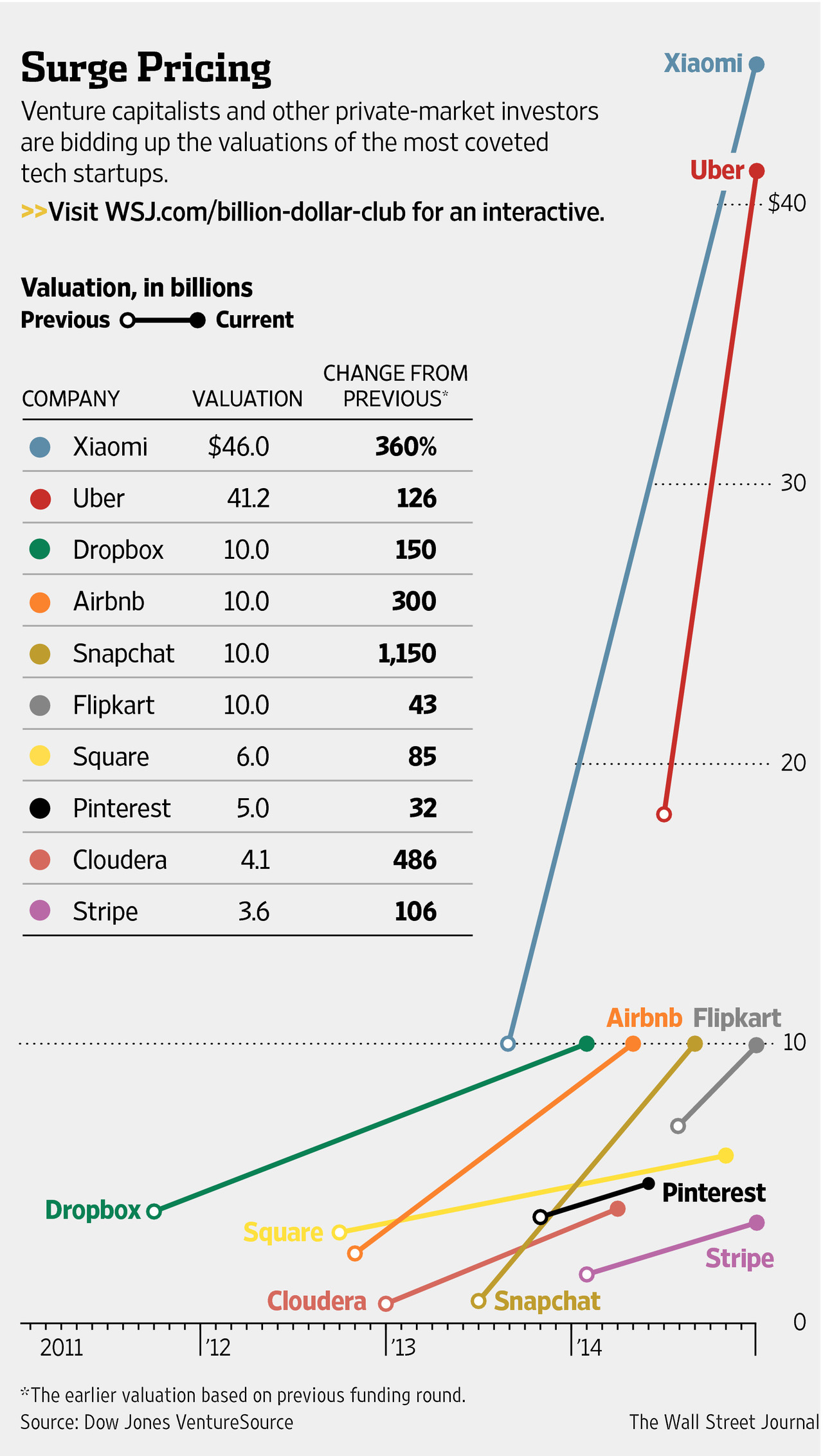

She also said she would like to start a venture-capital fund centered around the adult film industry.

Jennings — who did not return requests for comment — added that she would like to appear as a contestant on the new X-rated Internet reality show “The Sex Factor.”

The porn competition, set in Las Vegas, is scheduled to be hosted by Duke University porn star Belle Knox.

Sydney Leathers, who went into porn after being Anthony Weiner’s sexting pal, said Jennings’ career move could be a bad decision.

“I mean, she’s a babe, but realistically, porn is rarely a great choice for anyone,” Leathers told The Post. “I don’t regret it, but some people do.”

For the original article, click here.