![]() BrokerDealer.com blog update courtesy of Traders Magazine

BrokerDealer.com blog update courtesy of Traders Magazine

In honor of the upcoming U.S. Veteran’s day holiday, one Wall Street institutional broker is increasing the amount of profits it donates that are aimed to help U.S. servicemen and women.

Veteran’s Day is next Tuesday, November 11.

Mischler Financial. a California-based investment bank and institutional brokerage owned and operated by Service-Disabled Veterans, announced it is expanding its current give-back program. This year, the broker is donating a portion of its profits to three additional and separate non-profit organizations in honor of those who have served the country’s military.

The new charities are:

The Bob Woodruff Foundation

Children of Fallen Patriots

BuildOn.org

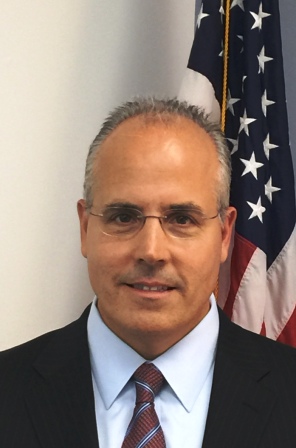

“Through our ongoing commitment to Veterans on Wall Street, this Veteran’s Day we are honored to pledge our financial support to these new organizations,” said Dean Chamberlain, chief executive and principal of Mischler Financial Group. “We also look forward to continuing our commitment to the non-profit devoted to inspiring our young generation to drive positive change through community service and education.”

Headquartered in Newport Beach, California with regional offices in Stamford, CT, Boston, MA and Chicago, IL., Mischler Financial Group is a federally-certified minority broker-dealer and a Service-Disabled Veterans Business Enterprise. It provides capital markets services, agency-only execution within the global equities and fixed income markets and asset management for liquid and alternative investment strategies