Fidelity Investments and investment banker/brokerdealer Credit Suisse have formed a partnership that gives Fidelity’s retail brokerage clients access to participate in initial public offerings and follow-on equity offering underwritten by Credit Suisse. The partnership opens up IPO investing for customers of Fidelity’s registered investment advisor (RIA) network, its family office clients and its retail brokerage customers who qualify.

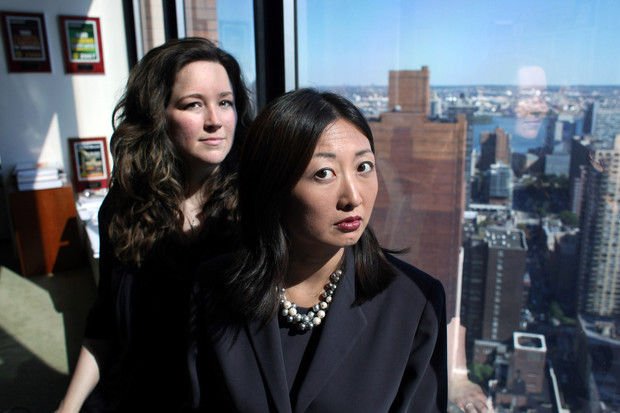

For Credit Suisse, the arrangement opens up its potential investor base to a wide arena of new customers. “It gives us the ability to distribute shares into the mass market that we didn’t have before,” David Hermer, Credit Suisse’s head of equity capital markets for the Americas, told New York Times DealBook.

About 232 companies have gone public so far this year, nearly 79 percent more compared with those in the period a year earlier, according to data from Renaissance Capital. By Mr. Hermer’s reckoning, the I.P.O. surge is still only in its early stages.

Credit Suisse completed 63 book-run IPOs in the first half of 2014, its most active half-year period on record. For that period, Credit Suisse ranks number two for IPOs in the U.S. and in the EMEA area–Europe, the Middle East and Africa. Looking ahead, Credit Suisse is working on several high-profile deals, including the much-anticipated IPO for Chinese internet company Alibaba.

And, the thinking goes, the more companies that Credit Suisse helps take public, the more that Fidelity customers benefit. The IPO participation is open to Fidelity investors with a minimum of $500,000 in retail assets.