Brokerdealer.com blog update courtesy of DealBreaker’s Bess Levin and for many clients, this story could be a deal breaker. UBS, a Swiss global financial services company with its headquarters in Basel and Zürich, Switzerland, UBS is operating in more than 50 countries with about 60,000 employees around the world, as of 2014. Some of these 60,000 employees have decided to attend a “sex club” in New York City. Below is an extraction from DealBreaker

Have you spent a good deal of time gazing upon your coworkers and thinking, “Working alongside each other is nice. Watching them scarf down Seamless has its perks. Burning the midnight oil to get these pitchbooks done is more fun than you’d think. But what I’d really like to do is attend a sex party with these people. But not just any old sex party put together in a slapdash manner and attended by people who give bondage gear a bad name. I’m talking a highly organized sex party produced by pros who know what they’re doing. Maybe someone with a British accent, who only has a couple degrees of separation from the Queen of England, and can lend an air of class to the event and know how to make a decent cup of Earl Grey. Someone whose roster of clients include the crème de la crème of f*cking. Someone who is not just a sex party planner but a serious businesswoman who did 7-figures in revenue last year by providing “A-list actors, British aristocrats, Formula One owners, moneyed married couples” and banking heirs with a smorgasbord of sexual delicacies”? Then today’s your lucky day.

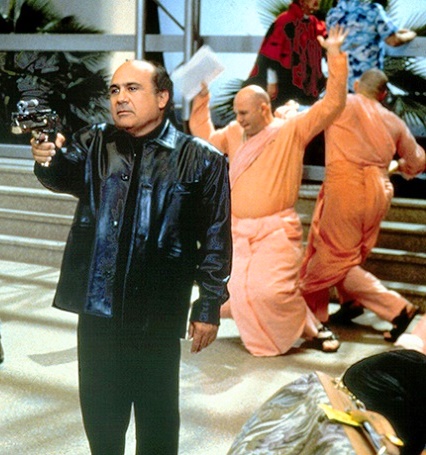

Leggy models in Christian Louboutin heels and Wolford stockings glide from room to candlelit room. A dapper man in a custom suit eyes them while sipping Champagne by the mansion’s fireplace. A DJ plays in a corner. Oysters are slurped at the bar. And then, in a matter of minutes, pants are off, bras are unhooked and a tangled web of nude revelers go at it on a bed plopped smack in the middle of the 12,000-square-foot home. It’s just another night at Killing Kittens — the roving members-only sex club that professes to be “the world’s network for the sexual elite.” On Saturday night, the kinky London-based club makes its New York debut. For $100 per woman and $250 per couple, the adventurous can spend hours sleeping with strangers in a swanky Flatiron loft rented for the evening. Cocktail attire and masks are required (though, needless to say, both will get shed rather quickly)…

“When [my ex-boyfriend and I] hosted a party at our house [in London], we had a bed and there were these two gorgeous silver foxes and this black girl whose legs went to Tokyo, and she was just demanding everything from them . . . it’s complete carnage,” she says. “It’s like a buffet.” […As of Tuesday, Sayle says 60 people have signed up for the NYC event, including a group of British female bankers who work at UBS’s Midtown office and a bevy of models. “They all have the same mentality,” a raspy-voiced Sayle says of her members.” They’re all overachievers.

For the entire article from DealBreaker, click here.

BrokerDealer.com blog update courtesy of extract from eFinancialCareers.com profile of Goldman Sachs foray into displacing Bloomberg LP’s dominance of chat and instant messaging tools used by brokerdealers throughout the world via

BrokerDealer.com blog update courtesy of extract from eFinancialCareers.com profile of Goldman Sachs foray into displacing Bloomberg LP’s dominance of chat and instant messaging tools used by brokerdealers throughout the world via