Two former bond brokers for broker-dealer Sterne Agee and an ex-PM overseeing fixed income investing for the NYS Retirement Fund were named as defendants in a pay-to-play scheme that had the brokers plying former fixed income portfolio manager with plenty of partying and prostitutes in exchange for millions of dollars in fixed income commission fees, according to the office of US Attorney Preet Bharara.

The indictment says that there was an agreement among ex PM Kang, and Sterne Agee executives Deborah Kelley and Gregg Schonhorn to pay Kang bribes in the form of “entertainment, travel, lavish meals, prostitutes, nightclub bottle service, narcotics, luxury gifts, and cash payments” among other things, in exchange for fixed-income business.

Prospectus.com team of capital markets experts and securities lawyers specialize in preliminary offering prospectus, secondary offering prospectus and full menu of financial offering memorandum document preparation. More information via this link – See more at: http://brokerdealer.com/blog/finra-trying-transparent-easy-trick/#sthash.rckLtkFf.dpuf

Prospectus.com team of capital markets experts and securities lawyers specialize in preliminary offering prospectus, secondary offering prospectus and full menu of financial offering memorandum document preparation. More information via this link – See more at: http://brokerdealer.com/blog/finra-trying-transparent-easy-trick/#sthash.rckLtkFf.dpuf

Prospectus.com team of capital markets experts and securities lawyers specialize in preliminary offering prospectus, secondary offering prospectus and full menu of financial offering memorandum document preparation. More information via this link – See more at: http://brokerdealer.com/blog/finra-trying-transparent-easy-trick/#sthash.rckLtkFf.dpuf

us_v._kang_and_kelley_indictment.pdf by Chris Bragg

The value of the alleged bribe was more than $1 million, Bharara’s office said, including such gifts as trips to New Orleans and Montreal, a ski trip to Park City, Utah, a $17,400 luxury wrist watch, tickets to Broadway shows and the U.S. Open, cocaine and crack cocaine, as well as thousands of dollars for strippers and prostitutes.

Prospectus.com team of capital markets experts and securities lawyers specialize in preliminary offering prospectus, secondary offering prospectus and full menu of financial offering memorandum document preparation. More information via this link -

More information via this link

Kang steered more than $2 billion in fixed-income business to the brokers, the indictment says, which resulted in millions in commissions.

Prospectus.com team of capital markets experts and securities lawyers specialize in preliminary offering prospectus, secondary offering prospectus and full menu of financial offering memorandum document preparation. More information via this link – See more at: http://brokerdealer.com/blog/finra-trying-transparent-easy-trick/#sthash.rckLtkFf.dpuf

(Reuters)-Dec 21 U.S. prosecutors on Wednesday accused a former portfolio manager at New York state’s retirement fund of steering $2 billion in trades in exchange for bribes from brokerage employees, in the latest pay-to-play case to rock the fund.

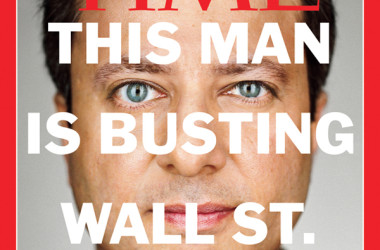

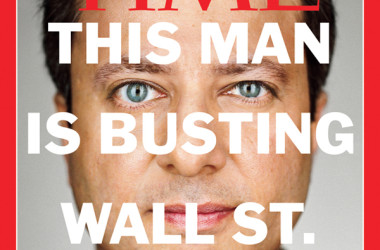

Navnoor Kang

Navnoor Kang, the ex-director of fixed income at the New York State Common Retirement Fund, was charged in an indictment filed in Manhattan federal court along with Deborah Kelley, a former Sterne Agee Group Inc managing director. Gregg Schonhorn, another broker-dealer whom prosecutors said paid bribes, was charged in related court filings (Reporting by Nate Raymond and David Ingram)

More Securities law news courtesy of Law360.com ….

Prospectus.com team of capital markets experts and securities lawyers specialize in preliminary offering prospectus, secondary offering prospectus and full menu of financial offering memorandum document preparation. More information via this link – See more at: http://brokerdealer.com/blog/finra-trying-transparent-easy-trick/#sthash.rckLtkFf.dpuf

Prospectus.com team of capital markets experts and securities lawyers specialize in preliminary offering prospectus, secondary offering prospectus and full menu of financial offering memorandum document preparation. More information via this link – See more at: http://brokerdealer.com/blog/finra-trying-transparent-easy-trick/#sthash.rckLtkFf.dpuf

Prospectus.com team of capital markets experts and securities lawyers specialize in preliminary offering prospectus, secondary offering prospectus and full menu of financial offering memorandum document preparation. More information via this link – See more at: http://brokerdealer.com/blog/finra-trying-transparent-easy-trick/#sthash.rckLtkFf.dpuf

Prospectus.com team of capital markets experts and securities lawyers specialize in preliminary offering prospectus, secondary offering prospectus and full menu of financial offering memorandum document preparation. More information via this link – See more at: http://brokerdealer.com/blog/finra-trying-transparent-easy-trick/#sthash.rckLtkFf.dpuf

Prospectus.com team of capital markets experts and securities lawyers specialize in preliminary offering prospectus, secondary offering prospectus and full menu of financial offering memorandum document preparation. More information via this link – See more at: http://brokerdealer.com/blog/finra-trying-transparent-easy-trick/#sthash.rckLtkFf.dpuf

-

A former Blackrock investment manager was sentenced to 12 months in prison by a London court on Wednesday for insider dealing stemming from trades in energy companies in 2011, in another win for the Financial Conduct Authority.

- December 20, 2016

A Texas financial adviser was arrested Monday on charges he cheated investors out of $6 million by selling unregistered securities in a purported digital advertising company that was really a Ponzi scheme, the Texas State Securities Board said.

- December 20, 2016

The Delaware Chancery Court opened a rare trial Tuesday for a so-called incentive award for the lead plaintiff in the class action that challenged Occam Networks Inc. merger with Calix Inc., which proposed at roughly $3 million is believed to be largest of its kind in the court’s history.

- December 20, 2016

A Washington, D.C., federal judge refused to move the U.S. Securities and Exchange Commission’s suit accusing government contractor RPM International Inc. of failing to account for a nearly $61 million settlement, saying Tuesday the Ohio company hadn’t proven it would be more conveniently heard elsewhere.

- December 20, 2016

The U.S. Securities and Exchange Commission and the Municipal Securities Rulemaking Board told the Sixth Circuit on Monday that it doesn’t have jurisdictional standing to consider the Republican Party’s challenge to new rules that increase pay-to-play restrictions on municipal advisers, saying the rules were created “by congressional will” and not by a final SEC order that can be appealed.

- December 20, 2016

Technology company NeuStar Inc. has agreed to pay $180,000 to end allegations that it violated a whistleblower protection rule by restricting what former employees were allowed to say about the company, the Securities and Exchange Commission announced Monday.

- December 20, 2016

The U.S. Securities and Exchange Commission reached its first settlement over internal-whistleblower retaliation Tuesday, with an Oklahoma energy company agreeing to pay $1.4 million, subject to a bankruptcy plan, to resolve claims it fired a worker for whistleblowing and used restrictive separation agreements.

- December 20, 2016

The Securities Industry and Financial Markets Association, the American Bankers Association and other swap market interest groups urged the U.S. Commodity Futures Trading Commission on Monday to hit the brakes on proposed definitions for U.S. and foreign entities under cross-border swap rules, underscoring potential harm to the U.S economy and potential regulatory overreach.

- December 20, 2016

Schulte Roth & Zabel LLP told a New York federal judge Tuesday that it will no longer represent Lynn Tilton’s Patriarch Partners in a breach of contract case against investment funds previously managed by Patriarch, citing “irreconcilable differences.”

- December 20, 2016

Delaware’s Chancery Court has said it will not allow OM Group Inc. shareholders to reargue their recently dismissed suit targeting the company’s board members over its $1 billion buyout by Apollo Global Management, finding that the court adequately considered the evidence at hand.

- December 20, 2016

Tokai Pharmaceuticals Inc. Monday sought to move a putative class action by investors claiming it withheld important drug testing information prior to its $97 million initial public offering to a Massachusetts federal court Monday.

- December 20, 2016

The Fourth Circuit on Tuesday found microcap broker-dealer Scottsdale Capital Advisors Corp. can’t challenge the Financial Industry Regulatory Authority’s power in federal court, because Congress gave exclusive review of FINRA rules and decisions to the U.S. Securities and Exchange Commission.

- December 20, 2016

Citibank NA on Tuesday again asked a New York judge to toss a proposed class action accusing the bank of ignoring pervasive problems with residential mortgage-backed securities, saying precedent from a recent state appellate ruling supports its contention that the suit is inadequately pled.

- December 20, 2016

A New York federal judge Tuesday dismissed a class of bondholders from multidistrict litigation accusing big banks of rigging the London Interbank Offered Rate, saying their alleged antitrust injuries were not caused by the banks.

- December 20, 2016

A Manhattan federal judge dismissed a class action lawsuit against New Source Energy Partners LP and underwriters over the company’s $40 million 2015 preferred-share offering Monday, finding that the bankrupt oil and gas portfolio’s risk-disclosures were “precise” and “exhaustive” and did not run afoul of the securities laws.

- December 20, 2016

Morgan Stanley & Co. LLC agreed to pay $7.5 million Tuesday to settle allegations it violated the U.S. Securities and Exchange Commission’s Customer Protection Rule when using customer cash as collateral on loans used to finance hedging swap trades.

- December 20, 2016

Bare claims of unfairness cannot overcome a partnership’s valid “special approval” shields for company decisions, Delaware’s Supreme Court said Monday in a ruling that rejected a master limited partnership member’s appeal of a losing challenge to a $446 million TransCanada Pipelines deal.

- December 20, 2016

An Illinois federal judge on Tuesday signed off on a deal that settles a yearlong legal dispute between the U.S. Commodity Futures Trading Commission and a Chicago-based trader accused of placing spoof bids on futures markets and who has now agreed to pay $2.5 million to resolve the suit before a trial.