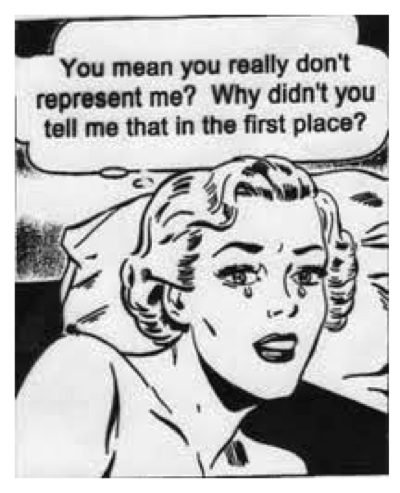

Brokerdealer.com blog update profiles the financial industry is bubbling thanks to SEC effort to redefine terminology and specifically, who it applies. In this case, the confusion comes in with who is a fiduciary and who isn’t. This blog update is courtesy of The Philadelphia Inquirer columnist, Erin Arvedlund. The excerpt below comes from both Arvedlund’s blog and her Monday column, “Monday Money Tip: Beware financial advisers who are not fiduciaries“.

Before you sign on with a money manager, ask: Are you a fiduciary? If yes, great. If not, go in with your eyes open.

Before you sign on with a money manager, ask: Are you a fiduciary? If yes, great. If not, go in with your eyes open.

Fiduciaries, by law, have to do the right thing by their clients. No one on Wall Street wants, by law, to have to do the right thing.

Some street professionals are fiduciaries; registered investment advisers generally are, brokers are not.

And the distinction grows every day.

Anyone whose job is to raise sales cannot meet the fiduciary standard, notes Knut Rostad, president of the Institute for the Fiduciary Standard.

“Brokers may provide useful product recommendations, but they cannot meet the fiduciary standard,” Rostad says.

“They can no more provide objective advice about investments than can the Ford car salesman objectively advise on cars. They may be terrific people but, by virtue of what they do, they will most assuredly provide terrible advice.”

The issue is confusing, and Wall Street wants to keep it that way.

Read the entire article from the The Philadelphia Inquirer, here, and for more financial commentary, click here for Erin Arvedlund’s blog.