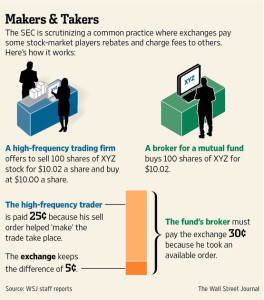

Exchange rebates paid to brokers for routing orders to their respective venues and the general issue with regard to the now ubiquitous “payment-for-order-flow” model that extends throughout the electronic trading ecosystem has been a topic of discussion for many years now. It may be confusing, but is certainly not an unknown concern to the universe of informed buy-side investors. For those who may be still be uninformed as to how/where/why/when (and how much?!) broker-dealers are on the receiving end of rebates, suffice to suggest its time you get yourself up to speed; your bottom-line can depend on it.

Courtesy of financial industry media outlet MarketsMedia’s all-star journalist Terry Flanagan most recent dissertation “Got Transparency?” it is one that deserves an accolade from altruists within the industry, if not a check under the hood or bottom of Terry’s car before he starts the engine.

“One aggravating factor is a lack of transparency. Many market participants do not know either the amount of the rebate or where it ends up.”

As Flanagan points out, “..In institutional equity trading, rebates have been a point of contention since the late 1990s, when Bill Clinton was U.S. President and the Dow Jones Industrial Average scaled 10,000 for the first time.

Supporters say exchanges paying rebates on order flow is a perfectly legitimate practice of rewarding customers and offering volume discounts. Helped by rebates, trading commissions have dropped substantially over the years; the biggest decline from 2005 to 2017 was 68% for the lowest-touch direct market access / algorithmic trades, according to Tabb Group research.

“Most buy-side firms operate with ‘all-in’ pricing models and aren’t provided granularity into fees by order, but the decisions on when and how to route to particular venues significantly impact execution performance…” according to Stino Milito, Co-Chief Operating Officer at Dash Financial Technologies.

On the other hand, critics say rebates create conflicts of interest, and shortchange end investors if brokers route in ways that disadvantages clients……Helped by rebates, trading commissions have dropped substantially over the years; the biggest decline from 2005 to 2017 was 68% for the lowest-touch direct market access / algorithmic trades, according to Tabb Group research.

“There is absolutely crap disclosure about broker-dealer routing strategies,” according to Dave Weisberger of ViableMkts. “If you can’t get a high-level view of how brokers route and what the outcomes are, then how can you be talking about a transaction fee pilot, or making claims about what rebates do to destroy the market?

Are you a startup fintech or blocktech firm that is seeking to raise capital and finding yourself ‘short of’ a cogent business plan or the proper investor offering documents?

Schedule your call with the senior executives at Prospectus.com LLC today

To read the entirety of Terry Flanagan’s piece in the latest edition of MarketsMedia, click here

The Great Rebate Debate..Broker Disclosure IS Front-Burner Topic