In a July 9 BrokerDealer.com blog post, we profiled the coverage of start-up company IEX, the innovative and self-acknowledged “disruptive” institutional equities order execution platform for brokerdealers that has received unheralded PR courtesy of the book “Flash Boys”, written by former securities industry member Michael Lewis.

Subsequent to BrokerDealer.com being contacted by IEX communications executive Gerald Lam in his effort to set the record straight re: erroneous news media coverage, this blog has kept an eye on IEX; below are extracts from an op-ed article written by IEX CEO Brad Katsuyama to Bloomberg LP and published on Aug 3

‘Flash Boys’ and the Speed of Lies

65 Aug 3, 2014 6:03 PM EDT

By Brad Katsuyama

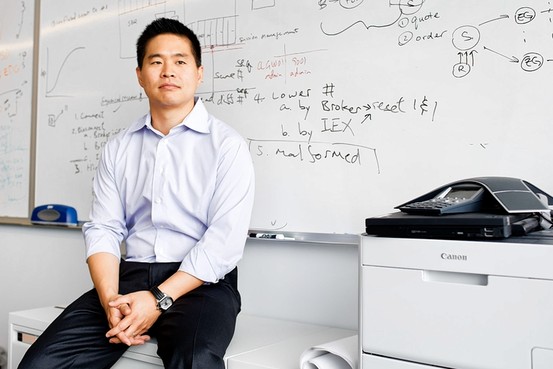

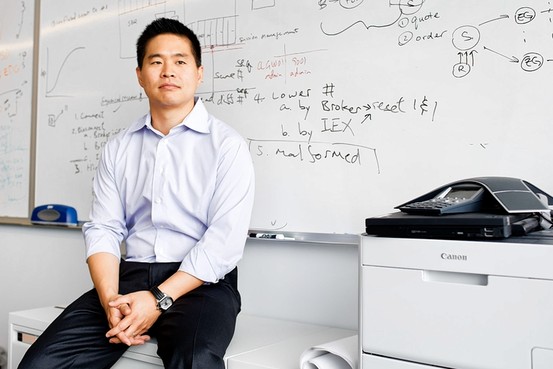

IEX CEO Brad Katsuyama, Image Courtesy of Wall St. Journal

In the last few months, I have had a strange and interesting experience. In early April, I found myself the main character in Michael Lewis’s book “Flash Boys.” It told the story of a quest I’ve been on, with my colleagues, to expose and to prevent a lot of outrageous behavior in the U.S. stock market.

Many of us had worked at big Wall Street brokerdealer firms or inside stock exchanges, and many of us believed something was amiss in the market. But it took the better part of five years to discover exactly how the market had been organized to benefit financial intermediaries, rather than the investors, the companies or the economy it was meant to serve. Only after looking at a flurry of market innovations — 40-gigabit cross-connects, esoteric order types, microwave towers — did we understand that the market’s focus was less about capital formation and more about giving certain market participants an advantage over others. In the end, we felt that the best way to solve these problems was to build a stock market of our own, which we did.

After the book, our stock market, IEX Group Inc., became a topic of discussion — some positive, some negative, some true and some false. Fair enough. If you’re in the spotlight and doing something different, you should take the heat along with the light.

It’s for this reason that we have done our best to resist responding publicly to misinformation about our company — even when we read memos circulated inside banks that “Michael Lewis has an undisclosed stake in IEX” (he does not); that “brokers own stakes in IEX” (they don’t); or articles in the Wall Street Journal that said we let “broker-dealers jump to the front of the trading queue,” putting retail investors and mutual funds at a disadvantage (in reality, all orders arrive at IEX via brokers, including those from traditional investors). Our hope in staying quiet was that the truth would win out in the end. But in recent weeks, the misinformation campaign has hit a new high (or low), and on one particularly critical matter, we feel compelled to set the record straight.

For the entirety of IEX CEO Brad Katsuyama’s Aug 3 op-ed piece to Bloomberg News, in which he seeks to dispel the erroneous information published by industry news media and select broker-dealer industry analysts, please visit the Bloomberg site at http://www.bloombergview.com/articles/2014-08-03/flash-boys-and-the-speed-of-lies

For those who are challenged with reading, Katsuyama was interviewed on Bloomberg TV Aug 5…The link to that video is http://www.bloomberg.com/video/iex-s-katsuyama-on-hft-full-exchange-ambitions-B0MB~4T7SIiBquvLC8nbLQ.html