BrokerDealer.com blog post courtesy of extracts from the Wall St. Journal

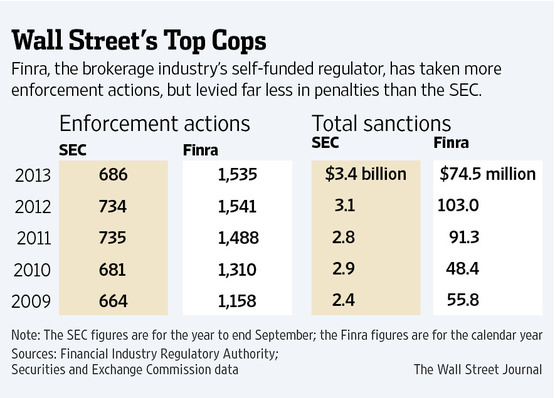

The Financial Industry Regulatory Authority aka Finra, the Wall Street watchdog charged with policing the brokerdealer community and overseen by the Securities and Exchange Commission (SEC), is considering tougher penalties for misconduct after criticism from an SEC official that its sanctions are too lenient.

In the five years since the financial crisis, Finra, which is funded by the industry, didn’t discipline any Wall Street executives. It imposed fines of $1 million or more 55 times through 2013, compared with 259 times for the SEC, according to a Wall Street Journal analysis. The SEC oversees a wider number of firms and range of conduct.

In the five years since the financial crisis, Finra, which is funded by the industry, didn’t discipline any Wall Street executives. It imposed fines of $1 million or more 55 times through 2013, compared with 259 times for the SEC, according to a Wall Street Journal analysis. The SEC oversees a wider number of firms and range of conduct.

Susan Axelrod, Finra’s executive vice president of regulatory operations, said in an interview the watchdog would review its guidelines to make sure penalties are “meaningful and will have an impact.”

She rejected any suggestion its punishments have been insufficient, adding that Finra, as “the cop on the beat from Wall Street to Main Street,” should not be judged just on its biggest fines. “We’re going to bring the action against the individual broker in Des Moines, Iowa, that other regulators are not going to bring. That’s a key part of our mission.”