Brokerdealer.com blog update includes extract from WSJ Nov 7 story

BrokerDealers and Financial Advisors take notice: stay away from college ball players, even if the rules and regulations that govern stockbrokers are not covered by the same rules that prohibit sports agents from fraternizing at fraternities or any other venue where college athletes could be ripe for solicitation.

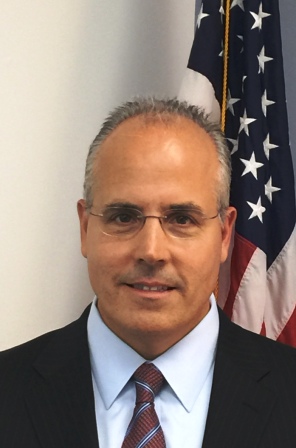

Steve Octavien is shown playing for the Dallas Cowboys in a 2009 loss against the Denver Broncos. After graduating from Nebraska, he invested $80,000 with financial adviser Mary Wong. He hasn’t been able to get back any of the money and believes she used it to pay her own credit-card bills and make other clients whole. Getty Images

Former Dallas Cowboys linebacker Steve Octavien recently landed a marketing job, got married, brought his newborn daughter home from the hospital and is saving up for the down payment on a house.

But as he gets on with life after six years of professional football, the 29-year-old Mr. Octavien regrets handing over $80,000, including his signing bonus, to a stockbroker named Mary Wong in 2008. They met while he was playing at the University of Nebraska, where he says she sometimes paid his rent, cellphone bills, car insurance and other expenses, a likely violation of National Collegiate Athletic Association rules.

The $80,000 soon disappeared, he says, and Ms. Wong pleaded guilty in 2010 to securities fraud related to an alleged Ponzi scheme that victimized other clients. She is serving a 63-month sentence in federal prison.

“Now I have a family,” says Mr. Octavien, who earned roughly $600,000 in his NFL career with four teams. “That would have been money that I would have loved to give them.” Prison officials say Ms. Wong told them she declined to comment for this article.

It is illegal in most states for sports agents to provide gifts or other items of value to amateur athletes—and agents are supposed to register with state regulators before approaching an athlete. Violators can be prosecuted.

Steve Octavien played linebacker from 2005 to 2007 at the University of Nebraska, where he says financial adviser Mary Wong sometimes paid his rent, cellphone bills, car insurance and other expenses. The gifts are a likely violation of National Collegiate Athletic Association rules but aren’t prohibited by current laws. Huskers

Those laws rarely apply to financial advisers like Ms. Wong. While NCAA rules prohibit athletes from accepting money or gifts from anyone trying to woo them, there is little to discourage financial advisers from trying.

The full article at WSJ

As a result, brokers, insurance agents, bankers and other types of financial advisers often contact athletes who are promising pro prospects, according to college athletic officials.