The school year may be winding down but investors are already looking forward to the back to school season for a likely launch of textbook company, McGraw-Hill Education’s initial public offering. Brokerdealer.com blog update profiles one of the largest educational publishers in the world, McGraw-Hill Education, and the rumors surrounding around the likelihood that they will be launching an IPO just in time for the new school year. This brokerdealer.com blog update is courtesy of Fortune and their article, “McGraw-Hill Education said to be preparing for IPO“, with an excerpt below.

McGraw-Hill Education is planning an initial public offering (IPO) as early as the fourth quarter of this year, potentially valuing the textbook company at around $5 billion, including debt, according to people familiar with the matter.

The company’s owner, private equity firm Apollo Global Management, has held talks with investment banks about the IPO, though their underwriter roles will not be finalized before the summer, four people said this week.

McGraw-Hill Education would aim to go public near the end of the year, following the back-to-school season when it generates the bulk of its revenue through textbook sales, the people added.

A spokesman for McGraw-Hill Education did not immediately respond to a request for a comment, while a spokesman for Apollo declined to comment.

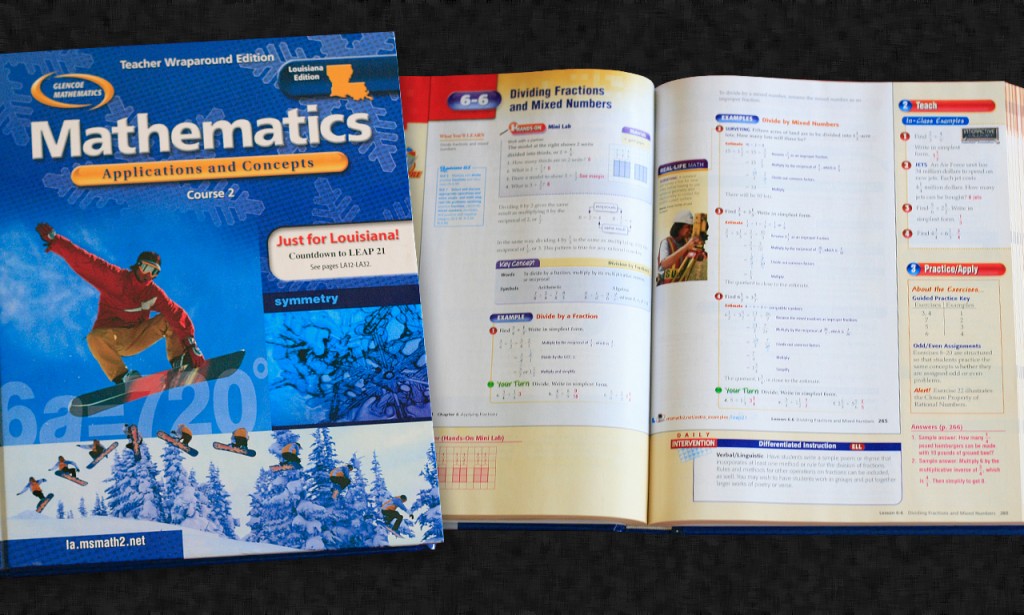

New York-based company McGraw-Hill Education is one of the largest educational publishers in the world, selling textbooks for school and university students and professionals in about 60 languages. It competes withPearson Plcand Cengage Learning Inc, and, like its peers, has sought to make most of its offerings available on the Internet as more people read books on tablets and phones.

To continue reading about McGraw-Hill Education’s IPO, click here.