Brokerdealer.com is providing below news extract courtesy of WSJ and reporter Tomi Kilgore

Investors are piling into the shares of small, risky companies at the fastest clip on record, in search of investments that promise a chance of outsize returns.

Investors are piling into the shares of small, risky companies at the fastest clip on record, in search of investments that promise a chance of outsize returns.

The investors are buying up so-called penny stocks—shares of mostly tiny companies that aren’t listed on major U.S. exchanges—at a pace that far eclipses the tech boom of the late 1990s. Those include firms that focus on areas from medical marijuana and biotechnology to fuel-cell development and precious-metals mining—industries that are perceived by some investors as carrying strong growth potential.

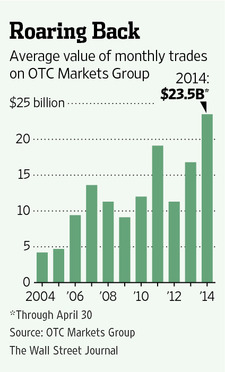

Average monthly trading volume at OTC Markets Group Inc., OTCM 0.00% which handles trading in shares that aren’t listed on the New York Stock Exchange or Nasdaq Stock Market, NDAQ +0.25% has risen 40% this year in dollar terms from a year ago, to a record $23.5 billion.

The renewed interest in a market that used to be known as the pink sheets—because of the colored pieces of paper once used to record prices for unlisted stocks—shows investors are ramping up risk in a bid to boost returns as U.S. stock indexes are hovering near highs and stock valuations have risen above historical norms.

The renewed interest in a market that used to be known as the pink sheets—because of the colored pieces of paper once used to record prices for unlisted stocks—shows investors are ramping up risk in a bid to boost returns as U.S. stock indexes are hovering near highs and stock valuations have risen above historical norms.

For the complete story from the Wall Street Journal, please click here