Goldman Sachs Group Inc. (GS) , the global investment bank/broker-dealer was accused of widespread gender discrimination and promoting a “boy’s club” atmosphere that included bouts of binge drinking and trips to strip clubs, as two former female employees seek to expand their lawsuit against the firm with new evidence.

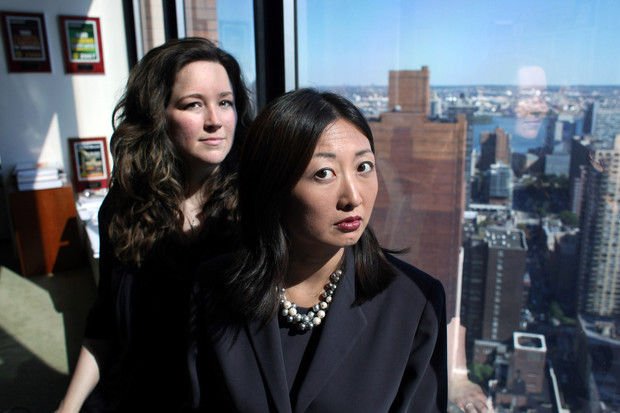

Photographer: Richard Perry/The New York Times via Redux. H. Cristina Chen-Oster, right, and Shana Orlich in New York City in this Sept. 15, 2010 file photo.

As reported by Bloomberg LP, “The women asked a federal judge in Manhattan today to let them sue on behalf of current and former female associates and vice presidents. Support for their claims includes statements of former Goldman Sachs employees, expert statistical analyses and evidence on earnings and promotions from the firm’s own records, they said in a court filing.”

In the suit, initially filed in 2010, the plaintiffs stipulate that female vice presidents of one of the world’s biggest banks earned 21 percent less than men and female associates made 8 percent less. About 23 percent fewer female vice presidents were promoted to managing director of the New York-based bank relative to their male counterparts, they said.

Goldman Sachs has denied the women’s claims and is fighting the case.