BrokerDealer.com blog update courtesy of multiple news sources.

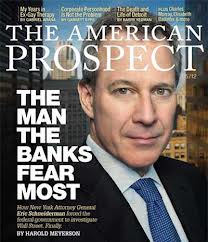

Less than two months after N.Y. Attorney General Eric Schneiderman levied charges against Barclays that it deliberately misled investors in its dark pool, regulators are reportedly looking into operations at five more investment banks. No specific allegations have been revealed, but several firms have confirmed that either Schneiderman’s office or another agency is investigating their practices.

The latest additions to the list of firms under scrutiny by the N.Y. attorney general’s office are Goldman Sachs and Morgan Stanley, according to The Fox Business Network, which cited people with direct knowledge of matter as sources. Neither firm has publicly acknowledged an investigation, but they also would not deny the scrutiny, according to the report.

Press officials at both firms as well as at the N.Y. attorney general’s office all declined comment.

One week ago, Credit Suisse revealed that regulators have asked the firm for information about its alternative trading system (ATS) as part of an investigation into dark pools. Credit Suisse said it was cooperating with “various governmental and regulatory authorities” regarding its ATS but would not specify which regulators were investigating, according to the Wall Street Journal. The bank further said that it is one of 30 defendants named in lawsuits related to high-frequency trading or other alleged violations filed with the U.S. District Court for the Southern District of New York.

Days earlier, UBS and Deutsche Bank disclosed that they were the subject of inquiries. UBS said that it was being investigated by the Securities and Exchange Commission, the N.Y. attorney general’s office and other regulators as part of an industry-wide investigation, according to the New York Times.

“These inquiries include an SEC investigation that began in early 2012 concerning features of UBS’s ATS, including certain order types and disclosure practices that were discontinued two years ago,” the firm said, according to the New York Times article.

At the same time, it was reported that Deutsche Bank separately disclosed it had been contacted by regulators. Deutsche Bank did not reveal which regulators had contacted the firm, but the New York Times report cited an unnamed source familiar with the matter as saying that the N.Y. attorney general’s office was investigating. Deutsche Bank and UBS both said they were cooperating with authorities.